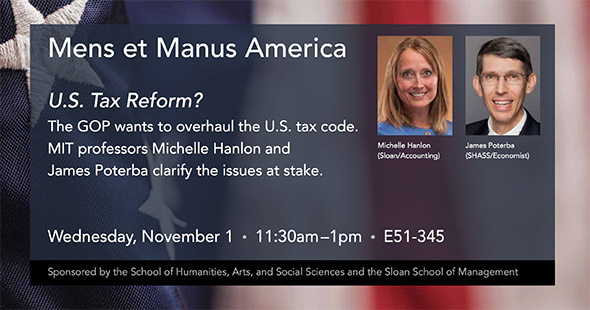

Mens et Manus America examines U.S. tax reform

MIT Professors James Poterba and Michelle Hanlon provide a primer on some key issues and challenges.

A "skinny house" in Amsterdam

“As you put a higher tax burden on some activity, individuals will try to do less of the thing you are taxing,” said MIT economist James Poterba, illustrating his point with an image of a skinny house in Amsterdam that was built at a time when buildings were taxed based on width. “The rate structure and what you’re taxing matters.”

President Reif's letter regarding federal tax proposals and the MIT community

15 November 2017

To the members of the MIT community: The tax legislation now pending in Congress contains several provisions that could have damaging impact on members of our community and the Institute as a whole. Because the situation is complex and fluid, I write to offer our current assessment of which provisions concern us the most and why, and to let you know that MIT is actively following developments in DC and striving to achieve a better outcome. If you share our concern, you can express your views to Congressional leaders.

MIT faculty members helped demystify the U.S. tax system and illuminate its possible restructuring on November 1 in a talk titled “U.S. Tax Reform: Options and Impediments.” The event took place just one day before GOP leaders in Washington unveiled a sweeping new tax reform bill.

“The politics of tax reform are extremely difficult, especially if you are trying to do it in a revenue-neutral way,” said James Poterba, the Mitsui Professor of Economics in the School of Humanities, Arts, and Social Sciences (MIT SHASS). “The devil is in the details.”

The details matter

Those details include everything from how taxes are apportioned among individuals and corporations, to what deductions are allowed and how foreign corporate earnings are taxed. Poterba provided a look at how the United States taxes individuals; Michelle Hanlon, the Howard W. Johnson Professor and a professor of accounting at the MIT Sloan School of Management, followed up with an outline of America's corporate tax system.

The well-attended event was one of a series sponsored by Mens et Manus America, a non-partisan MIT initiative focused on addressing current social, political, and economic challenges in the United States. Professor Agustín Rayo, associate dean of SHASS and a co-organizer of the initiative, introduced the speakers.

Taxes impact behavior

Both experts emphasized that taxes impact behavior. “As you put a higher tax burden on some activity, individuals will try to do less of the thing you are taxing,” said Poterba, illustrating his point with an image of a skinny house in Amsterdam that was built at a time when buildings were taxed based on width. “The rate structure and what you’re taxing matters.”

Hanlon said corporations behave the same way, noting that the current system encourages businesses to keep cash in foreign subsidiaries to avoid paying taxes on earnings brought into the country. “Companies have a high incentive to shift income, to put income somewhere where the rate is lower,” she said.

The full specifics of the new GOP tax plan were still unknown at the time of the talk, but Hanlon and Poterba both noted that tax reform efforts have a checkered history in the United States, with many good-faith efforts going nowhere. The last really sweeping reform — a bill that had bipartisan support and changed both individual and corporate tax parameters — took place in 1986 under President Reagan, Poterba said, adding that “There’s been nothing like that since.”

Video | On U.S. tax reform issues

For a more complete introduction to the U.S. tax system and more details about the issues governing the current tax reform debate, watch the lively presentations by Professors James Poterba and Michelle Hanlon, which include informative graphics and charts, and even some tax humor.

Some basics about the current tax system

In addition, today’s reform efforts face some serious “fiscal headwinds,” he said. The federal deficit — a measure of how much more the government spends than it takes in — stands at about $440 billion and counting, and the most recent budget is projected to add a cumulative $1.5 trillion to deficits over the next 10 years.

“If the goal for the next three decades is to preserve the debt-to-GDP (gross domestic product) at its current ratio, that implies a fiscal gap of nearly 2 percent,” he said. "That means that some combination of tax increases and spending cuts totaling about 2 percent of GDP per year would be needed to keep debt from rising as a share of GDP."

To help event attendees understand proposed reforms, Poterba provided a basic outline of the current tax system. He noted that the individual income tax collects most of its revenue from a modest fraction of the population: about 58 percent of income tax is paid by households with income over $200,000; they represent just over 4 percent of tax filers. If the goal of reform is to promote economic growth, Poterba said, the key is to promote investment and capital accumulation, or to encourage labor supply, or to do both.

Corporate taxes

On the corporate side of the spectrum, Hanlon explained that America’s corporate tax system is currently out of sync with other countries around the world. While most countries set their corporate income tax rate at or below 25 percent, the U.S. rate stands at 35 percent.

In another diversion from common practice, the United States taxes corporate earnings "worldwide," rather than just taxing the earnings a corporation makes in this country. This prompts companies to save money overseas, Hanlon said. U.S. companies are estimated to be holding more than $2.5 trillion in cash in foreign subsidiaries to avoid the 35 percent tax that would be collected if they brought the money back to the U.S.

Despite the flaws in the current system, Hanlon said reforming the tax code is extremely difficult because there are so many competing interests. Even popular opinion plays a role, she said, noting that Starbucks recently decided to pay U.K. taxes it didn’t owe to quiet protesters who were complaining that the company should pay more.

“Tax reform requires balancing many competing goals,” Hanlon said.

A Sampler of Views on Current U.S. Tax Reform Plans

President Reif's letter regarding federal tax proposals and the MIT community

15 November 2017: To the members of the MIT community: The tax legislation now pending in Congress contains several provisions that could have damaging impact on members of our community and the Institute as a whole. Because the situation is complex and fluid, I write to offer our current assessment of which provisions concern us the most and why, and to let you know that MIT is actively following developments in DC and striving to achieve a better outcome. If you share our concern, you can express your views to Congressional leaders.

Andrea Campbell, head of MIT Political Science on the proposed tax reform

Commentary in Foreign Affairs Magazine

Ford professor of economics Jonathan Gruber on tax reform

Commentary on WGBH

GOP tax plan seeks to shake up education tax credits, deductions, and benefits

Story at the Washington Post

Two concerns about the GOP tax plan

First, it disproportionately benefits the rich at a time when income inequality is an economic, political and social concern. Second, the concept of a debt-creating tax plan is unwise and counterproductive.

Commentary at The Washington Post

Impact of Republican tax proposal on higher education

Story at The Chronicle of Higher Education

How to make a good tax reform plan even better

Commentary by Edward Lazear in The Wall Street Journal

Americans aren't taxed enough

Commentary by Robert Samuelson in the Washington Post

The GOP could still salvage their tax plan. But they have to think small.

Commentary by Derek Thompson at the Atlantic

Corporate tax reform is the key to growth

Martin Feldstein in the Wall Street Journal

Suggested Links

Video: MIT professors James Poterba and Michelle Hanlon on tax reform issues

For a more complete introduction to the U.S. tax system and more details about the issues governing the current tax reform debate, watch the lively presentations by MIT Professors James Poterba and Michelle Hanlon, which include informative graphics and charts, and even some tax humor.

Michelle Hanlon

Howard W. Johnson Professor of Accounting, MIT Sloan

James Poterba

Mitsui Professor of Economics, MIT SHASS

Mens et Manus America Initiative

A joint project of two MIT Schools: SHASS and Sloan

21st Century Citizenship | MIT SHASS Resources for Understanding and Engagement

Agustín Rayo

Professor of Philosophy, Associate Dean, MIT SHASS

Ezra Zuckerman Sivan

Siteman Professor of Strategy and Entrepreneurship, Deputy Dean, MIT Sloan

About Mens et Manus America

The Mens et Manus America Initiative explores social, political, and economic challenges currently facing the United States. The nonpartisan initiative is co-sponsored by the MIT School of Humanities, Arts, and Social Sciences and the MIT Sloan School of Management, and is co-directed by Agustín Rayo, professor of philosophy and associate dean of SHASS, and Ezra Zuckerman Sivan, Siteman professor of strategy and entrepreneurship and deputy dean of MIT Sloan.

Previous events and feature stories

Jason Jay on How to Have Productive Conversations in a Polarized World

Adam Berinsky and Ezra Zuckerman-Sivan examine The Politics of Misinformation

Sociologist Arlie Hochschild discusses Finding Common Ground

Initiative launches with Anthropologist Christine Walley's documentary film: Exit Zero

Story prepared by MIT SHASS Communications

Kathryn O'Neill, Senior Writer; Emily Hiestand, Editorial and Design Director

Top Photograph: A "skinny house" in Amsterdam; photocredit: Kraskland, Flickr, CC

Published November 13, 2017